Damit Pty Ltd an Australian company is engaged by MM Sdn Bhd to build a dam in Ulu Langat Selangor. Payments for technical advice assistance or services is subjected to withholding tax including any portion of work done outside Malaysia.

Withholding Tax Su Fang Associates Facebook

For example the DTA between Malaysia and Singapore reduces withholding tax rate in respect of royalties and technical fees to 8 and 5 respectively.

. WHT Dividends 1 Interest 2 Royalties 3a 3b Special classes of incomeRentals 4 5 Resident corporations. Of that 1500 parts of it goes to state income tax federal income tax unemployment and Medicare liabilities. The Company may withhold from all payments due to Executive or his beneficiary or estate hereunder all taxes which by applicable federal state local or other law the Company is required to.

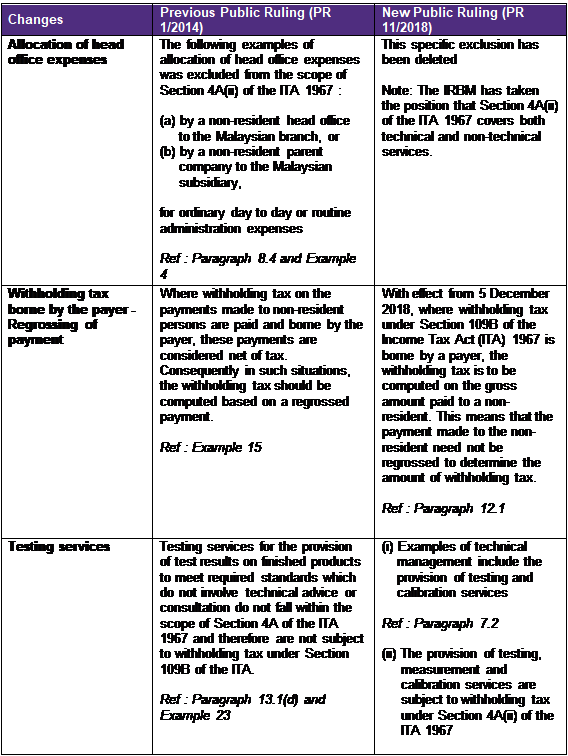

When a company pays for goodsservices a fixed percentage say 3 is deducted. The withholding tax provisions under the Act place tremendous demand on payers and hence a good understanding of the Malaysian withholding tax regime is critical to avoid any potential on non-compliance penalties. He is required to withhold tax on payments for services renderedtechnical advice.

As the name goes Withholding tax means an amount representing the tax portion of an income of a non-resident recipient withheld by the payer in Malaysia and paid directly to the Inland Revenue Board of Malaysia. The IRS defines regular pay eg. 030 Malaysian ringgits MYR per litre is applicable.

Income Tax Act 1967. Assuming that the foreign service provider is based in Singapore if the service is considered under Special Classes of Income eg. The following countries have concluded double tax treaties with Malaysia.

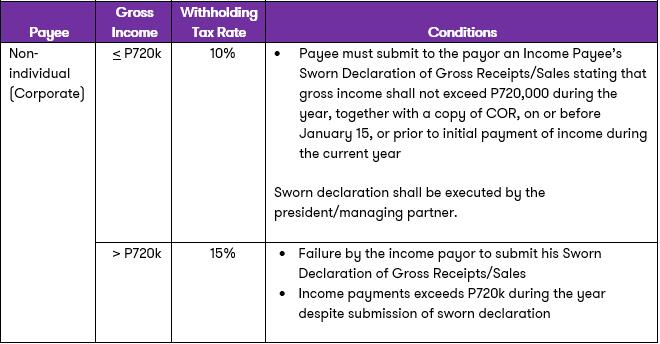

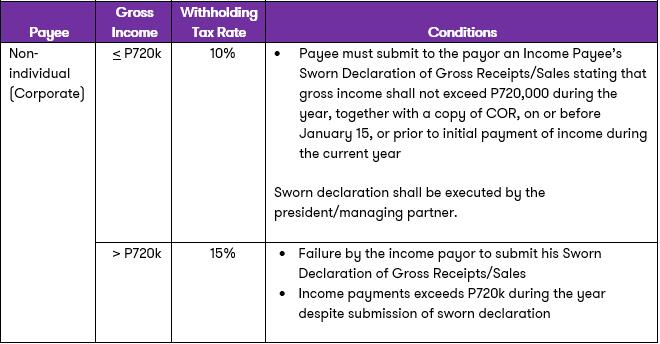

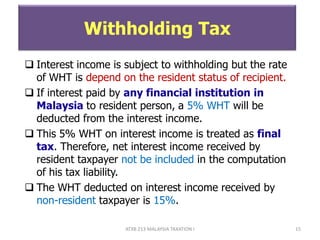

Corporations making payments of the following types of income are required to withhold tax at the rates shown in the table below. Withholding tax also known as retention tax is a government requirement whereby the tax amount is collected from the source of income generated rather than from the recipientIn other words tax on income earned is paid by the giver and not by the receiver. Technical Fees it will.

An individual body company carrying on business in Malaysia. Lets say Johns yearly salary is 72000. The calculation includes income related to commissions vacation pay reimbursements and.

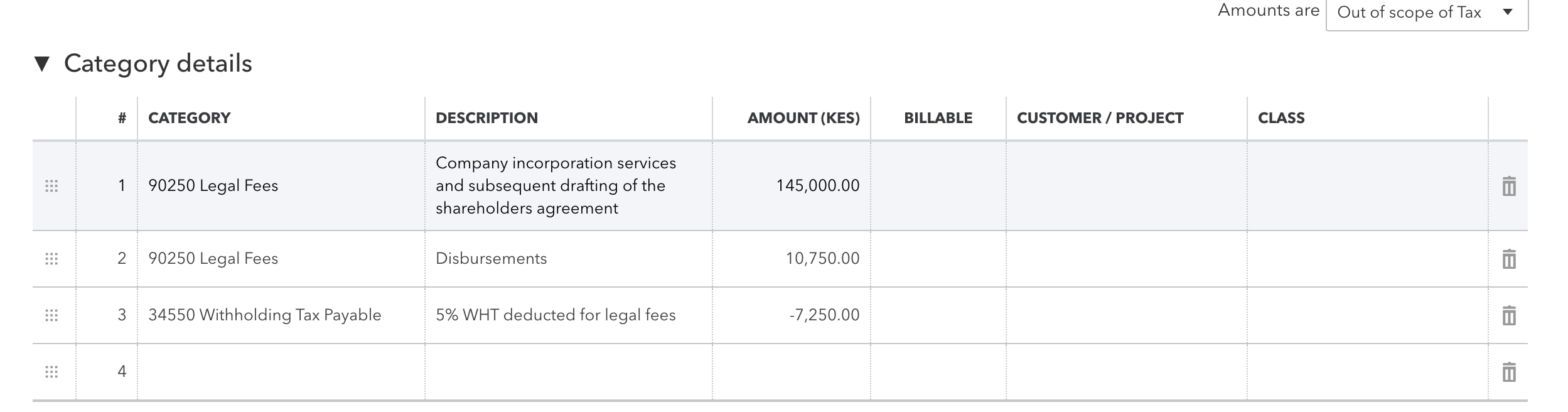

Payer refers to an individualbody other than individual carrying on a business in Malaysia. Company N is a foreign company providing services to a Malaysian company called Company M. The gross amount which billed from Company N is equivalent to RM10000.

What is withholding tax. Income is deemed derived from Malaysia if. Form CP37A Pin 52017.

Withholding tax rates are 10 3 The 10 is in respect of the tax liabilities of the non-resident contractor while the 3 is for the tax liabilities of the employees of the non-resident contractor. This form can be downloaded and submitted to Lembaga Hasil Dalam Negeri Malaysia. Goods exempted from Sales Tax include basic food eggs vegetables cereals pharmeceutical products and steel products.

For example A engages B who is a foreign consultant to give consultation on a project and pays 100000. The payer has to make the payments based on the table below. Lets assume the withholding tax rate is 10.

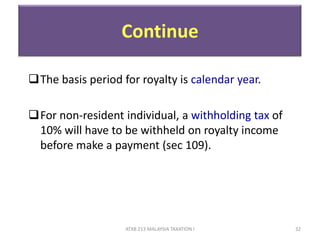

Is set at 2 22 24 32 35 and 37. Introduction to Withholding Tax. Any tax resident person who is liable to make certain specified types of payments to a non-resident is required to deduct withholding tax at a prescribed rate applicable to the gross payment and remit it to the Malaysian IRB within one month of paying or crediting.

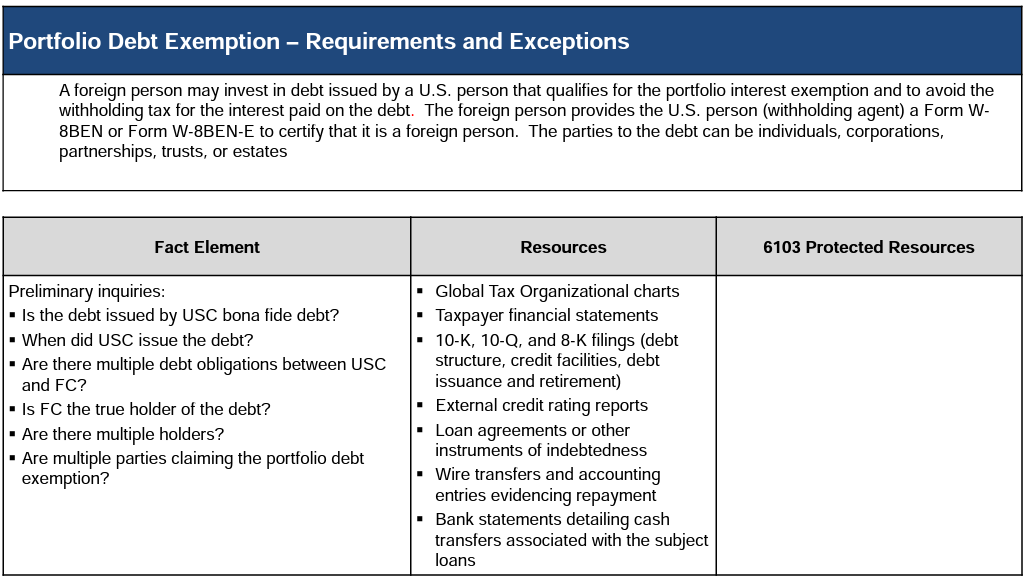

See Note 5 for other sources of income subject to WHT. What Is The Withholding Tax Rate. These DTAs commonly provide for either an exemption or reduction in the prescribed rate for certain types of withholding taxes.

Section 107A 1 a 107A 1 b 10 3. Quoting directly from the Inland Revenue Board of Malaysias official website withholding tax is an amount that is withheld by the party making payment payer on income earned by a non-resident payee and paid to the Inland Revenue Board of Malaysia IRBM. Withholding tax means an amount.

Let us assist you to demystify the changes made to the withholding tax provisions and support you in complying with your withholding. A specific Sales Tax rate eg. The withholding tax in Malaysia is an amount withheld by the party making payment payer on income earned by a non-resident payee.

Example of Withholding Tax. The dam will take 1 year to be built. Incomes Are ax Withholding.

Under the S109B Income Tax Act 1967 A would need to withhold 10 of that. Malaysia has entered into more than 60 bilateral DTAs. What Are The Examples Of Withholding Tax.

You need to. To withholding tax has been redefined effective 17th January 2017 resulting in significant broadening of the scope of payments to which the withholding tax applies. Withholding tax is an amount withheld by the party making payment payer on income earned by a non-resident payee and paid to the IRB.

For taxpayers that have the digital certificates for individual files SG or OG or the digital certificates for company files OeF- file C they can now pay withholding taxes under form CP37A electronically to IRBM via e-WHT. See All 392 Withholding Taxes. Example 1 Syarikat Maju Sdn Bhd a Malaysian company signed an agreement with Excel Ltd a non-resident company to provide a report addressing the industry structure market conditions and technology value for the Multimedia Super Corridor Grant Scheme.

Depending on an employees income and filing status they may be required to pay federal withholding tax. For example if the payment date is 15042022 the period for remittance. Though he earns 6000 a month his employer withholds 1500 from his paycheck leaving 4500 for John.

Malaysia is subject to withholding tax under section 109B of the ITA. Individuals except 1099 employees can easily look. Goods which are subject to 5 percent Sales Tax include certain food prepared fruits vegetables and meats printers and mobile phones.

Company N is a foreign company providing services to a Malaysian company called. Withholding tax is an amount withheld by the party making payment payer on income earned by a non-resident payee and paid to the Inland Revenue Board of Malaysia. A 2 Withholding Tax WHT will be imposed to agents dealers or distributors whose commission exceed RM100k within 1 year.

This amount has to be paid to LHDN.

Payments That Are Subject To Withholding Tax Wt

Portfolio Interest Exemption Advanced American Tax

Portfolio Interest Exemption Advanced American Tax

Demystifying Malaysian Withholding Tax Re Run Kpmg Malaysia

Profit Repatriation From China Inward Foreign Investment China

New Withholding Rules On Payments Of Professional Talent And Commission Fees Grant Thornton

What Is The Double Entry For Withholding Tax Quora

Tax Alert Grant Thornton Malaysia

Chapter 5 Non Business Income Students

Chapter 5 Non Business Income Students

Form W 8ben Definition Purpose And Instructions Tipalti

Details Of 2 Agent Commission Withholding Tax L Co

Step By Step Document For Withholding Tax Configuration Sap Blogs

How To Do Payroll Yourself For Your Small Business Gusto

Solved How To Record And Pay Withholding Tax On Supplier

Bbva Bank Statement Template Mbcvirtual Statement Template Bank Statement Templates

25 Great Pay Stub Paycheck Stub Templates Excel Templates Templates How To Plan

Withholding Tax On Income Under Paragraph 4 F